Delving into the realm of obtaining the most affordable auto insurance quotes without any hidden fees, this introduction beckons readers with a wealth of knowledge and insights presented in a captivating manner.

Exploring the intricacies of factors affecting insurance costs, researching tips for finding budget-friendly options, utilizing discounts, and negotiating with insurance companies will be the focus of this informative piece.

Understand the Factors Affecting Auto Insurance Quotes

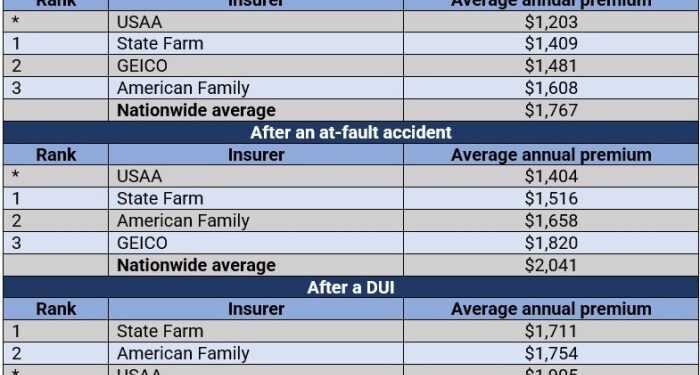

When looking for the cheapest auto insurance quote, it's important to understand the various factors that can influence the cost of your premium. By knowing what affects your insurance rates, you can make more informed decisions to get the best deal possible.One of the main factors that impact auto insurance costs is the type of vehicle you drive.

Insurance companies consider the make, model, and year of your car when determining your premium. Generally, newer and more expensive vehicles will have higher insurance rates due to the cost of repairs or replacements.Another significant factor is your driving record.

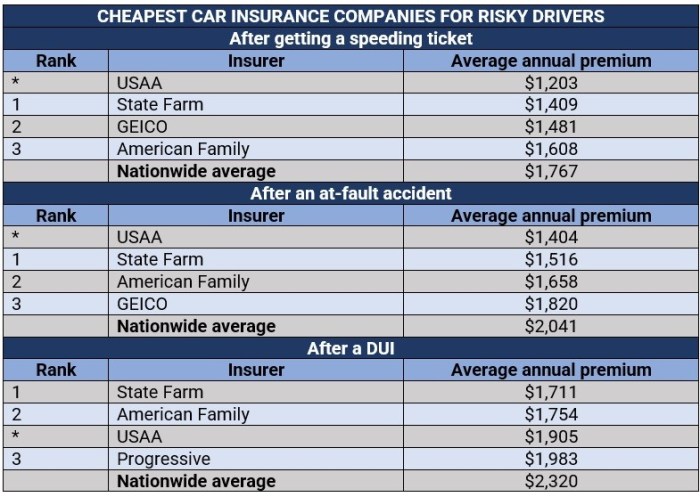

If you have a history of accidents or traffic violations, insurance companies may see you as a higher risk driver, resulting in higher premiums. On the other hand, a clean driving record can lead to lower insurance rates as you are perceived as a safer driver.The location where you live also plays a role in determining your insurance premiums.

Urban areas with higher rates of accidents or theft may have higher insurance costs compared to rural areas. Additionally, areas prone to extreme weather conditions or natural disasters can impact insurance rates.Age, gender, and credit score are other factors that can affect your auto insurance quotes.

Younger drivers typically pay more for insurance due to their lack of driving experience, while gender can also influence premiums. Moreover, individuals with lower credit scores may be charged higher rates as they are perceived as higher risk customers.

Type of Vehicle, Driving Record, and Location Impact

- The type of vehicle you drive, including make, model, and year, can affect insurance rates.

- Your driving record, with accidents or traffic violations, can lead to higher premiums.

- Location plays a role in insurance costs, with urban areas and high-crime neighborhoods resulting in higher rates.

Role of Age, Gender, and Credit Score

- Younger drivers tend to pay more for insurance due to their lack of experience on the road.

- Gender can also impact premiums, with some companies charging different rates based on gender.

- Credit score is considered by insurers, with lower scores often resulting in higher premiums.

Research Tips for Finding Affordable Auto Insurance

When it comes to finding affordable auto insurance, conducting thorough research is key. By comparing quotes from different providers, checking for hidden fees, and understanding policy coverage, you can ensure you are getting the best deal possible. Utilizing online tools and resources can also help streamline the process and lead you to the best insurance rates available.

Strategies for Researching and Comparing Insurance Quotes

- Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Consider bundling policies (such as auto and home insurance) to potentially receive a discount.

- Look for discounts based on your driving record, age, or affiliations with certain organizations.

Importance of Checking for Hidden Fees and Understanding Policy Coverage

Before committing to an auto insurance policy, make sure to carefully review the terms and conditions. Look out for any hidden fees or charges that could significantly impact the overall cost. Additionally, ensure you understand the coverage provided by the policy to avoid any surprises in the event of an accident.

Exploring Online Tools and Resources for Obtaining the Best Insurance Rates

- Use comparison websites that allow you to input your information once and receive quotes from multiple insurers.

- Take advantage of insurance calculators to estimate your premiums based on different coverage levels and deductibles.

- Consider reaching out to independent insurance agents who can help navigate the options and find the best rates for your specific needs.

Utilize Discounts and Bundling Options

When it comes to getting the cheapest auto insurance quote without hidden fees, taking advantage of discounts and bundling options can significantly lower your premiums

Common Discounts Offered by Insurance Companies

- Good driver discount: Maintaining a clean driving record with no accidents or traffic violations can make you eligible for a good driver discount.

- Multi-vehicle discount: Insuring multiple vehicles under the same policy can lead to a discount on your premiums.

- Low mileage discount: If you don't drive your car often, you may qualify for a low mileage discount.

- Good student discount: Students with good grades may be eligible for a discount on their auto insurance.

Benefits of Bundling Auto Insurance with Other Policies

- Cost savings: Bundling your auto insurance with other policies like home or renters insurance can result in a significant discount on your overall insurance costs.

- Convenience: Having all your insurance policies with one provider can make it easier to manage and keep track of your coverage.

- Additional discounts: Some insurance companies offer additional discounts for customers who bundle multiple policies with them.

Maintaining a Good Driving Record and Completing Defensive Driving Courses

- Safe driver discount: By maintaining a good driving record and avoiding accidents or traffic violations, you can qualify for a safe driver discount.

- Defensive driving course discount: Completing a defensive driving course can not only make you a safer driver but also lead to discounts on your auto insurance premiums.

Tips for Negotiating with Insurance Companies

When it comes to negotiating with insurance companies for the best possible rate, preparation is key. By being informed and ready to ask about discounts, you can increase your chances of getting a more affordable auto insurance quote. Here are some strategies to help you negotiate effectively:

Know Your Information

- Before contacting insurance agents, make sure you have all the necessary information about your driving history, the type of coverage you need, and any existing discounts you may qualify for.

- Having this information readily available shows the insurance company that you are a well-informed customer and can help in negotiating a better rate.

- Ask about any available discounts based on your driving record, age, or any safety features in your vehicle. Sometimes, these discounts are not automatically offered, so it's essential to inquire about them.

Leverage Competing Quotes

- Don't hesitate to shop around and gather quotes from multiple insurance companies. Use these competing quotes as leverage when negotiating with your current provider.

- Inform your current insurance company about the lower quotes you've received from other insurers and see if they are willing to match or beat those rates.

- Competition among insurance companies can work to your advantage, so don't settle for the first quote you receive. Use the power of comparison to negotiate a better deal.

Final Review

In conclusion, navigating the world of auto insurance quotes without hidden fees can be a daunting task, but armed with the right information and strategies, finding the best deal is within reach. Stay informed, compare quotes diligently, and leverage available discounts to secure the most cost-effective coverage for your vehicle.

Quick FAQs

What factors influence auto insurance costs?

Factors such as the type of vehicle, driving record, location, age, gender, and credit score all play a role in determining insurance premiums.

How can I find affordable auto insurance quotes?

Research different providers, check for hidden fees, understand policy coverage, and utilize online tools to compare rates effectively.

What are some common discounts offered by insurance companies?

Insurance companies often provide discounts for maintaining a good driving record, completing defensive driving courses, and bundling auto insurance with other policies like home or renters insurance.

What are some tips for negotiating with insurance companies?

Prepare information, ask about available discounts, and leverage competing quotes to negotiate the best possible rate with insurance agents.